does colorado have inheritance tax

Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately. If it does its up to that person to pay those taxes not the inheritors.

Thats especially true for.

. After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. What documents or supporting evidence do you have. A state inheritance tax was enacted in Colorado in 1927.

In some states a person who receives an inheritance might. Form 706 or 706NA for a nonresident alien decedent is required to be filed. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022.

The good news is that Colorado does not have an inheritance tax. The recoupling does not affect the. Colorado does not have an inheritance tax or estate tax.

But that there are still complicated tax matters you must handle once an individual passes away. Tax Return DR 1210 must be filed if a United States Estate and Generation-Skipping Transfer Tax Return federal. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

When clients move from other states or have been consulting with family in other states or currently own property in other statesthey often arrive at our office with questions and even confusion about the state of taxation in. Third and even more importantly for Louisiana residents if your estate is not structured correctly the property in your estate may be subject to the INCOME tax by foreging the step up in basis at death. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere.

An important note here however is that if the individual youre receiving inheritance from resides in a state with inheritance tax then it can apply regardless of the state you live in. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Delivery Spanish Fork Restaurants.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. Opry Mills Breakfast Restaurants. Essex Ct Pizza Restaurants.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional. Anything else you want the lawyer to know. You may be required to pay inheritance tax if all of the deceaseds property all money property and assets is worth more than gbp 325000 and the deceaseds estate is unable or unable to pay.

While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place. Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. Inheritance Laws in Colorado.

In kentucky for instance inheritance tax must be paid. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. It happens only if they inherit an estate from a state that still levies local inheritance taxes that apply to the out-of-state heirs as well.

Colorado does not have inheritance taxes but there are federal estate taxes. There is no inheritance tax in Colorado. 9117 amended December 23 2003.

There is no inheritance tax or estate tax in Colorado. The state of Colorado for example does not levy its own inheritance tax. No documents just wanting to let them know what Colorado does.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. In 2021 federal estate tax generally applies to assets over 117 million. Restaurants In Matthews Nc That Deliver.

How does inheritance tax work for Colorado residents. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. No colorado does not have an inheritance tax.

Does Colorado Have An Estate Or Inheritance Tax. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself. Soldier For Life Fort Campbell.

This is what I call the hidden estate tax. Form 706 or 706NA for a nonresident alien decedent is required to be filed. In fact only six states have state-level inheritance tax.

Colorado also has no gift tax. Does colorado have a inheritance tax. Estate tax is a tax on assets typically valued at the.

But that there are still complicated tax matters you must handle once an individual passes away. No Colorado does not have an inheritance tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

There is no federal inheritance tax but there is a federal estate tax. Inheritances that fall below these exemption amounts arent subject to the tax. A state inheritance tax was enacted in colorado in 1927.

First estate taxes are only paid by the estate. A state inheritance tax was enacted in colorado in 1927. Until 2005 a tax credit was allowed for federal estate.

My children are worried they are going to pay an outrageous amount of taxes when I die. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. There is no estate or inheritance tax in Colorado.

Inheritance taxes are different. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax.

Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. Technically there is only one case where a Colorado resident would have to pay an inheritance tax. Income Tax Rate Indonesia.

Colorado Inheritance Tax and Gift Tax. Up to 25 cash back Does Colorado have a state inheritance tax. In fact only six states have state-level inheritance tax.

It operates almost like an. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. The inheritance tax in Florida is the legal rate at which the state of Florida taxes the estate of a deceased person.

Colorado Tax Code Lexisnexis Store

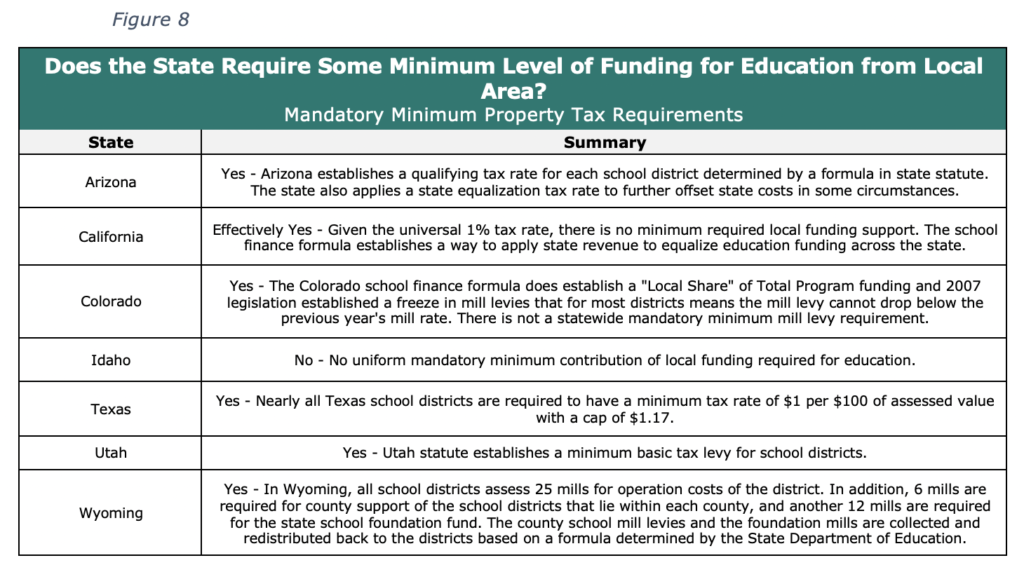

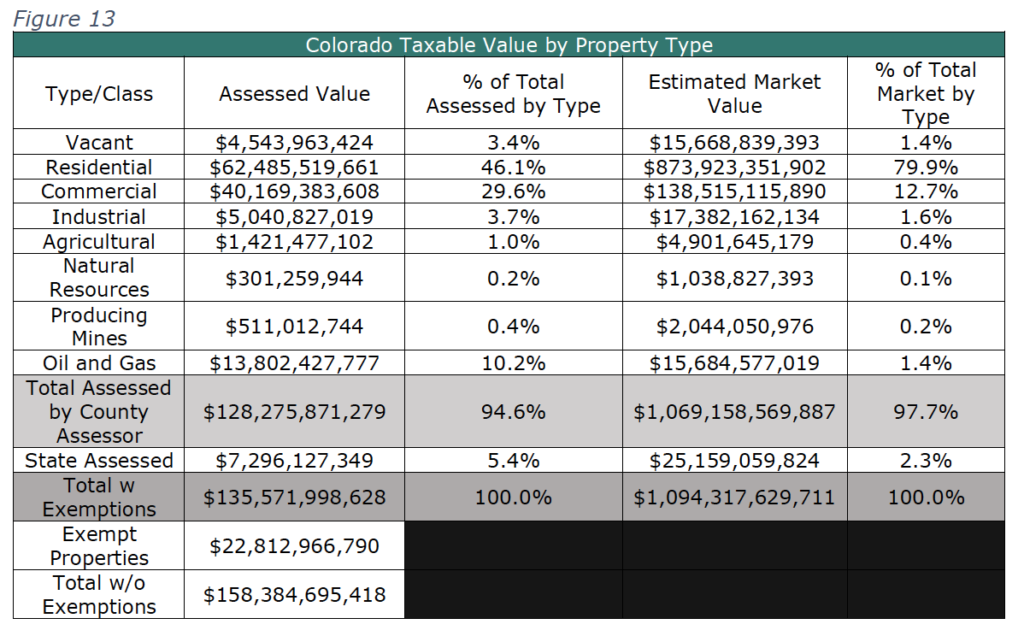

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Big Changes Coming To Colorado Trust Law Evergreen Legacy Planning

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Historical Colorado Tax Policy Information Ballotpedia

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

All About Life Insurance Infographic Life Insurance Facts Life Insurance Sales Life Insurance Companies

Where S My Colorado State Tax Refund Taxact Blog

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Tax Consequences When Selling A House I Inherited In Denver Colorado Durangobagel

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute